AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110079 – Free SAP FICO Certification by SLA Consultants India,

- Street: 82-83, 3rd Floor, Vijay Block, Above Titan Eye Shop, Metro Pillar No. 52,Laxmi Nagar, New Delhi,110092

- City: Delhi

- State: india

- Country: India

- Zip/Postal Code: 110092

- Contact No: +919205283200

- Email ID: [email protected]

- Website: https://www.slaconsultantsindia.com/

- Listed: April 25, 2025 6:28 am

- Expires: 22 days, 14 hours

Description

AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025

The rise of artificial intelligence (AI) and automation is undeniably transforming industries worldwide, including accounting. AI technologies, such as machine learning, robotic process automation (RPA), and advanced data analytics, are increasingly taking over routine accounting tasks, from bookkeeping and data entry to financial reporting and analysis. While these innovations are enhancing efficiency, human expertise will remain in high demand in the accounting profession in 2025 and beyond. Here’s why:

AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110079 – Free SAP FICO Certification by SLA Consultants India

1. The Role of AI in Accounting: Automation of Routine Tasks

AI and automation tools are excelling in automating repetitive tasks, such as data entry, transaction matching, and report generation. These technologies can process vast amounts of data quickly and accurately, reducing the margin for human error. For instance, AI-powered software can track invoices, process payments, and handle bookkeeping, freeing accountants from mundane tasks. While AI’s efficiency in these areas is undeniable, it cannot replicate the critical thinking, judgment, and strategic insights provided by human accountants.

2. Strategic Decision-Making and Advisory Roles

As AI handles routine financial tasks, accountants will transition into more strategic roles, including advisory positions where their financial insights, business acumen, and judgment are vital. In 2025, accounting professionals will be expected to provide more than just number crunching. They will play a central role in advising businesses on financial strategies, budgeting, investment planning, and risk management.

3. Understanding and Navigating Complex Regulations

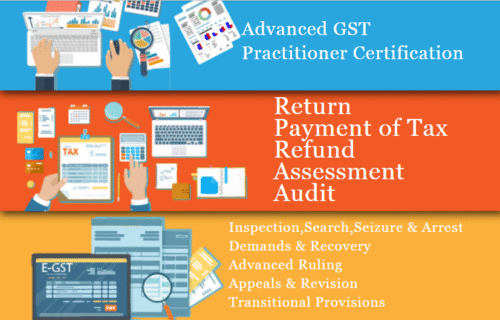

The accounting field is deeply intertwined with regulations, such as tax laws, compliance requirements, and financial reporting standards. As regulations evolve, accountants must stay up-to-date with changes in tax codes, industry regulations, and accounting standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). In regions like India, where the Goods and Services Tax (GST) system is in place, accountants need to understand the nuances of GST, audits, returns, and compliance—areas where human judgment and expertise are still crucial.

AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110079 – Free SAP FICO Certification by SLA Consultants India

4. Personalized Client Relationships and Ethical Considerations

Accountants often work closely with clients, providing personalized advice and building relationships based on trust and understanding. This human touch is something AI cannot replicate. Accountants build long-term client relationships, offering customized financial advice and ensuring their clients’ financial strategies align with their personal or business goals. Furthermore, accounting professionals play a vital role in ensuring ethical standards and preventing fraud, an area where human judgment remains indispensable.

5. Free SAP FICO Certification by SLA Consultants India: Preparing for the Future

To stay competitive in the accounting profession in 2025, professionals must develop expertise in both traditional accounting and emerging technologies. Free SAP FICO Certification by SLA Consultants India is one such opportunity for accountants to acquire expertise in one of the most widely used financial software systems in the world. SAP FICO (Financial Accounting and Controlling) integrates financial accounting with other business processes, allowing businesses to streamline operations, improve decision-making, and ensure financial transparency. Proficiency in tools like SAP FICO will help accountants manage complex financial systems and enhance their roles in strategic planning and analysis.

Conclusion: Human Expertise in a Technological World

While AI and automation will undoubtedly continue to enhance efficiency in the accounting field, human expertise will remain an irreplaceable asset in 2025 and beyond. Accountants will continue to provide strategic insights, navigate complex regulations, offer personalized client relationships, and maintain ethical standards. By investing in skills like SAP FICO and GST certification, accounting professionals can position themselves as valuable assets in an increasingly automated world, ensuring that their expertise remains in demand for years to come.

SLA Consultants AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110079 – Free SAP FICO Certification by SLA Consultants India details with New Year Offer 2025 are available at the link below:

https://www.slac

13 total views, 2 today